The Order Block Indicator is a device utilized in trading and technical evaluation to determine potential reversal factors out there. It is an idea usually utilized in the Forex market, however it can be utilized to different monetary markets. The Order Block Indicator is primarily based on worth motion and helps traders determine important levels where institutional merchants (or "sensible money") positioned their buy or sell orders.

Here's the way it works:

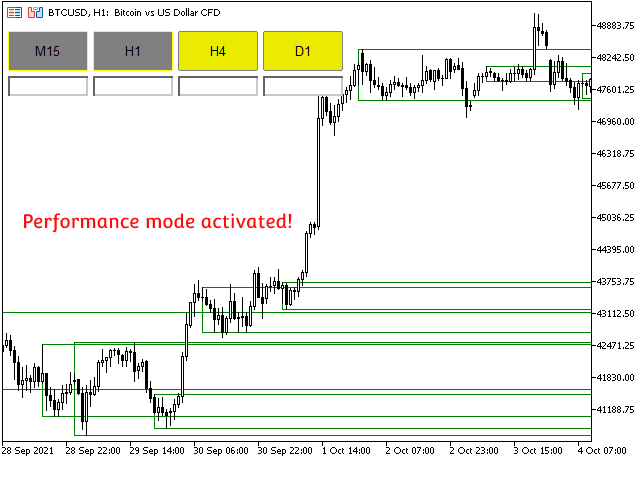

Identification of Institutional Orders: Institutional merchants, because of the size of their trades, go away behind "order blocks" on the worth chart. These blocks represent areas where significant shopping for or promoting exercise occurred.

Recognition of Order Blocks: Traders identify these order blocks on their charts. An order block usually consists of a bullish candle (for a buy order block) or a bearish candle (for a promote order block) where the institutional orders were placed.

Price Retests: After the initial order block is formed, the value often retests this degree. If the value approaches the order block and then reverses, it can signal that the institutional orders are nonetheless influential at that level.

Confirmation Signals: Traders search for further confirmation alerts, such as candlestick patterns or different technical indicators, to verify the potential reversal. These alerts help merchants make extra informed choices about getting into or exiting trades.

Trade Execution: Traders may enter a trade based on the presence of an order block and affirmation indicators. For instance, if price approaches a buy order block and reveals indicators of reversal, a trader may enter an extended (buy) commerce.

It's necessary to note that while the concept of order blocks is widely discussed in trading circles, it isn't a standardized indicator like moving averages or oscillators. Traders typically develop their own methods for identifying and using order blocks based mostly on their experience and analysis.

As with any trading technique, it's essential for merchants to completely check their method, handle risks successfully, and consider using correct threat management techniques to guard their capital. Additionally, The original source ought to keep up to date with the newest market situations and constantly refine their methods primarily based on changing market dynamics..